Are you thinking about investing in stocks and shares but don’t know where to start? You’re not alone. Many first-time investors feel overwhelmed by the jargon and the complexity of the stock market. This guide aims to demystify the process and help you take your first steps with confidence.

What Are Stocks and Shares?

Stocks and shares represent ownership in a company. When you buy shares of a company, you become a part-owner of that company. If the company does well, the value of your shares may increase, and you might also receive dividends, which are a share of the company’s profits.

Why Invest in Stocks and Shares?

Investing in stocks and shares can be a great way to grow your money over time. Historically, the stock market has offered higher returns compared to savings accounts and bonds. However, it’s important to remember that investing always comes with risks, and the value of your investments can go down as well as up.

Getting Started: Steps for First-Time Investors

1. Educate Yourself

Before you start investing, it’s crucial to understand the basics. There are many online resources, books, and courses that can help you learn about the stock market, investment strategies, and financial planning.

2. Set Your Investment Goals

Decide what you want to achieve with your investments. Are you saving for retirement, a house, or just looking to grow your wealth? Your goals will influence your investment strategy.

3. Determine Your Risk Tolerance

Investing in stocks can be risky. Think about how much risk you’re willing to take. Generally, younger investors can afford to take more risks because they have more time to recover from any losses.

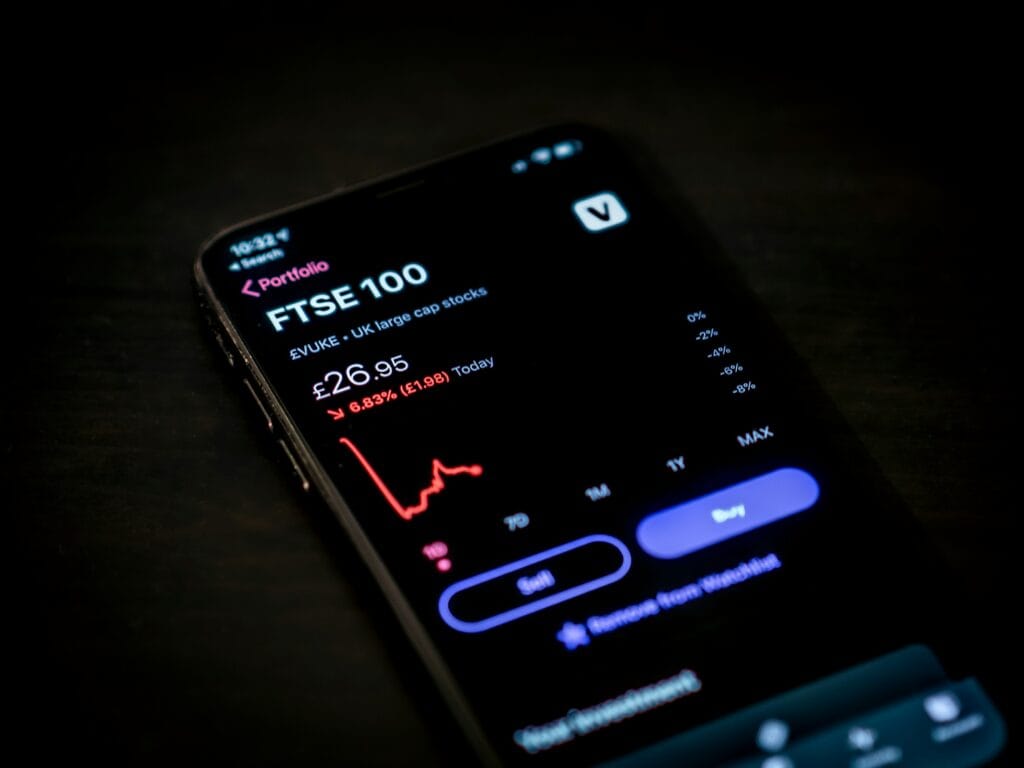

4. Choose a Brokerage Account

To buy and sell shares, you need a brokerage account. There are many online brokers in the UK, such as Hargreaves Lansdown, AJ Bell, and eToro. Compare their fees, features, and customer service to find one that suits you.

5. Start Small

When you’re new to investing, it’s wise to start with a small amount of money. This way, you can learn how the market works without risking too much of your savings.

6. Diversify Your Portfolio

Don’t put all your eggs in one basket. Spread your investments across different companies, industries, and asset types to reduce risk. This is known as diversification.

7. Consider Funds and ETFs

If picking individual stocks seems daunting, consider investing in funds or exchange-traded funds (ETFs). These are collections of stocks that are managed by professionals, allowing you to invest in a wide range of companies with a single purchase.

Key Tips for Success

- Stay Informed: Keep up with market news and trends. This will help you make informed decisions about your investments.

- Be Patient: Investing is a long-term game. Don’t panic during market downturns; instead, stay focused on your long-term goals.

- Review Your Portfolio Regularly: Periodically check your investments to ensure they’re aligned with your goals. Rebalance your portfolio if necessary.

Common Mistakes to Avoid

- Chasing Hot Stocks: Avoid the temptation to buy stocks just because they’re popular. Do your research and invest in companies with solid fundamentals.

- Timing the Market: Trying to predict market movements is nearly impossible. Focus on long-term growth rather than short-term gains.

- Ignoring Fees: Be aware of the fees associated with trading and maintaining your brokerage account. High fees can eat into your returns over time.

Conclusion

Investing in stocks and shares can be a rewarding way to build wealth, but it’s important to approach it with knowledge and caution. By educating yourself, setting clear goals, and following a disciplined investment strategy, you can navigate the stock market with confidence. Remember, every great investor started somewhere, and with the right approach, you can become successful too.

4 comments

The block blast gameplay you guide gives me a lot of confidence.

Your help is greatly appreciated. Thank you so much! Play game block blast free.

The thoroughness of your analysis is truly impressive. admire your ability to convey such detailed information in an accessible way.

I was thoroughly impressed by the clarity and depth of your writing. cookie clicker